Medical Excise Tax Maintenance |

|

|

|

Medical Excise Tax Maintenance |

|

|

Usage:

This new federal excise tax will go into effect on Jan 1, 2013 and the feature has been incorporated into DLCPM. There are 2 options when setting up this tax. Labs may either opt to assume the tax amount or pass it on to customers like other sales taxes. For reporting the tax liability, if your lab decides to assume this tax, there is a new Report in the Report Center to provide the tax liability. If the tax is paid by the customer, it will appear on the existing Tax Liability Report.

Navigation: File > Global Settings > Global > Laboratory Lists > Medical Excise Tax

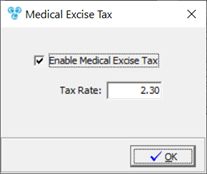

Medical Excise Tax form

1.Follow the File > Global Settings > Global > Laboratory Lists > Medical Excise Tax navigation path to open the Medical Excise Tax form 2.Check the Enable Medical Excise Tax option 3.Enter the Tax Rate. The rate is set to 2.3 as required by IRS. 4.Click OK to save the changes. 5.Users will need to update each customer's specific settings and check the check box option for Subject to Medical Excise Tax.

6.You will need to identify which product is subject to this tax by checking the respective checkbox. When DLCPM V7.5 is installed, this option is automatically marked for all existing products. You will need to uncheck the box for any exceptions. Please note that the master settings must be enabled for the product to be taxed. You can administer the appropriate changes here.

Please note: As part of the upgrade to V7.5, all customers that are on record as being located in the United States have already been marked to being subject to the excise tax. However this is not the only setting that needs to be enabled in order for a customer to incur the tax.

|

1.Follow the File > Global Settings > Global > Laboratory Lists > Medical Excise Tax navigation path to open the Medical Excise Tax form 2.Uncheck the Use Medical Excise Tax option. 3.Click OK to save the changes. |

If the customers are paying the taxes, you can use the existing “Tax Liability” report which will include this tax automatically. However, if you have decided to increase your prices or pay the tax, look for the new report, "Medical Deivce Excise Tax Liability" located in the accounting folder in the Report Center. |

See also: