Functionality |

|

|

|

Functionality |

|

|

Usage: The integration with Avalara AvaTax is designed to calculate sales tax by the integration pulling up to date sales tax information each time a case is entered, invoice and transferred over to Avalara. Outlined below is the major functionality of the integration once the configuration is completed.

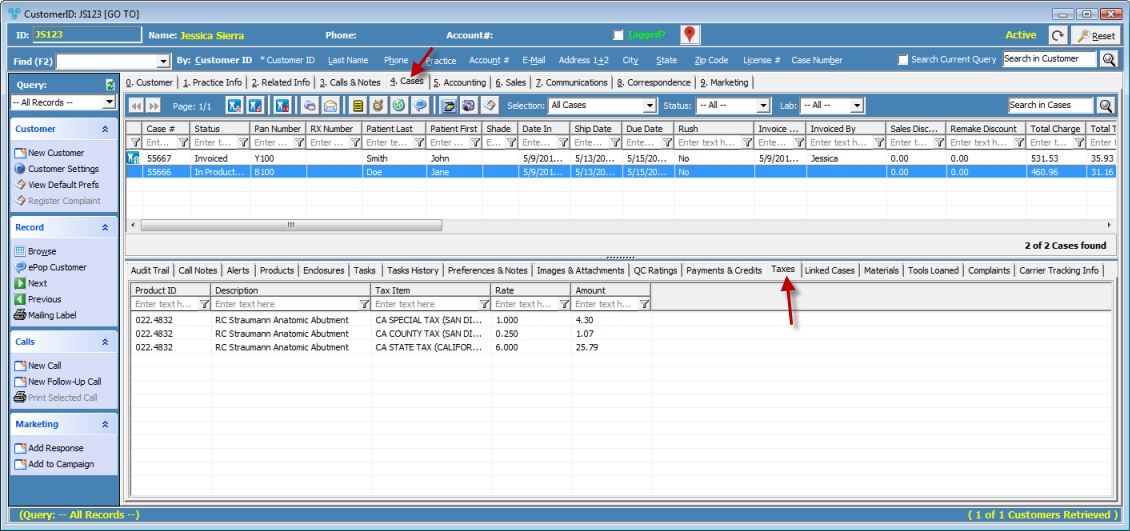

1. Create Case: When a case is entered, the integration communicates with Avalara AvaTax to calculate the sales tax that is applicable to the customer account and the products entered on the case. This will give the user an idea of the sales tax that will be confirmed upon invoicing.

Taxes tab on case form - after case is created

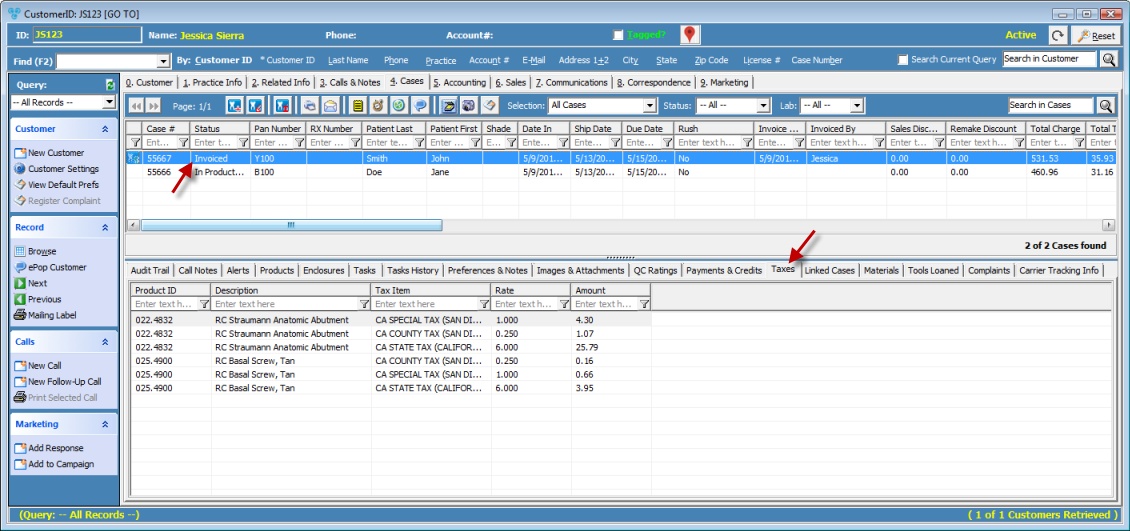

2. Invoice Case: When a case is invoiced, the integration communicates again with Avalara AvaTax to calculate the sales tax that is applicable to the customer account and the products finalized on the case prior to invoicing.

Taxes tab on case form - after case is invoiced

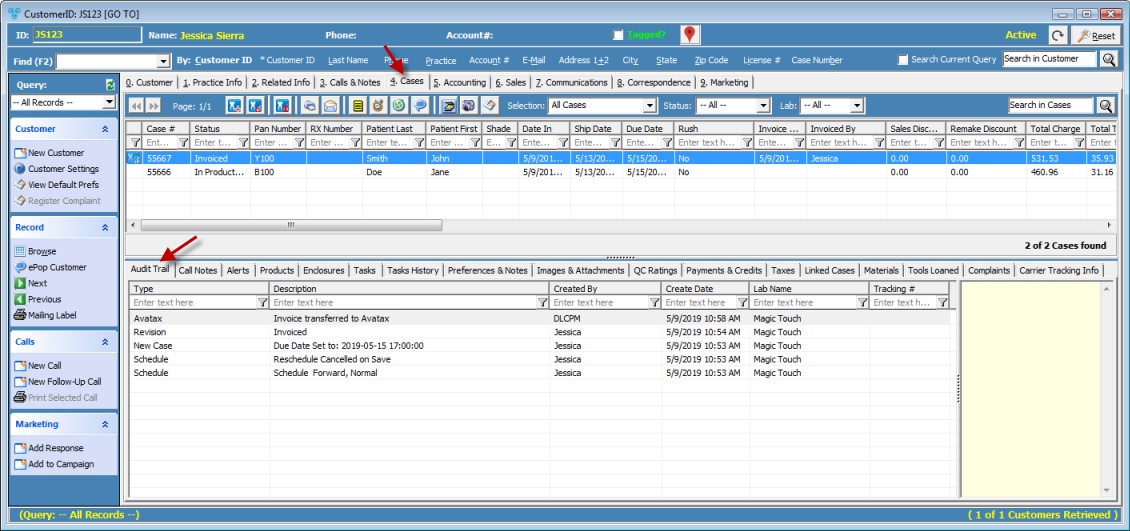

3. Transfer Invoice: In order to transfer invoices from DLCPM over to Avalara AvaTax, there is a nightly automation service that will run and upload all invoiced cases that should transfer over to Avalara AvaTax. Once an invoice has been successfully transferred over to AvaTax, an audit trail log will display the successful transfer along with the date and time of the transfer.

Audit Trail tab on case form

See also: