Configuration |

|

|

|

Configuration |

|

|

Usage: Once an account has been established, you will need to enable the tax integration service and configure the Global Settings, Lab Settings, Customers and Products accordingly.

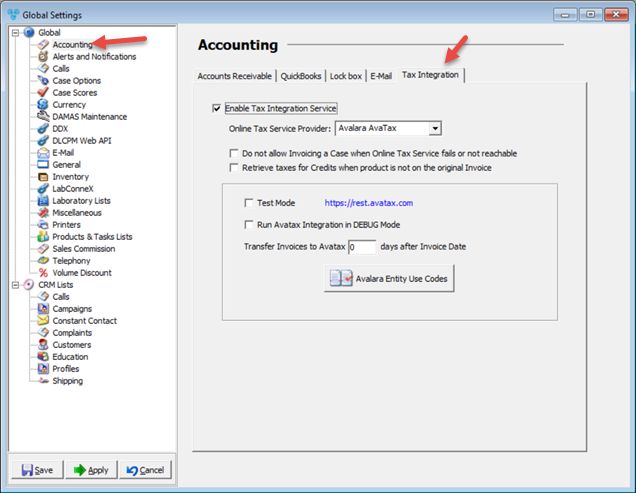

1. Navigation: File > Global Settings > Global > Accounting > Tax Integration

Accounting - Tax Integration - Avalara Ava Tax

•Enable Tax Integration Service : This option must be checked in order to access the subsequent options and activate the remaining configuration settings listed below. Once checked, select Avalara AvaTax as the Online Tax Service Provider from the drop down menu.

•Do not allow Invoicing a Case when Online Tax Service Fails or not reachable: With this option checked, users will not be able to invoice a case if Avalara is not reachable or fails to connect through the integration. This will ensure that if there is a technical issue that requires troubleshooting, the user is not able to invoice until the technical issue is resolved.

• Retrieve taxes for Credits when product is not on the original Invoice - When activated, this will ensure that sales tax is properly calculated on credit memos where products on the credit memo are different from the original for all methods of creating a credit memo.

•Transfer Invoices to AvaTax ___ days after Invoice Date: This field allows for administrative users to set a delay on when invoices should be transferred over to Avalara after the invoice date.

•Avalara Entity Use Codes: This is a maintenance which will allow users to manually create entity use codes to set on customers and/or products. This list also automatically generates any use codes that are configured in the Avalara AvaTax account through the Avalara portal.

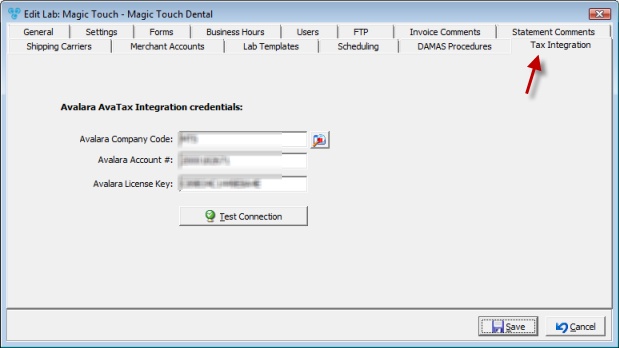

2. Navigation: File > Global Settings > Global > Laboratory lists > Laboratories > Edit Lab > Tax Integration

Edit Laboratory in Settings - Tax Integration tab

•Once the Global Settings has been configured, it is required next to define the Avalara AvaTax Integration credentials in Laboratory settings. These credentials are provided by Avalara when an account is established. The credentials required are the following:

➢Avalara Company Code

➢Avalara Account #

➢Avalara License Key

•It is important that once all three of the credentials have been completed to select the option for Test Connection. This will ensure that all credentials entered are correct and the system is able to communicate to Avalara successfully.

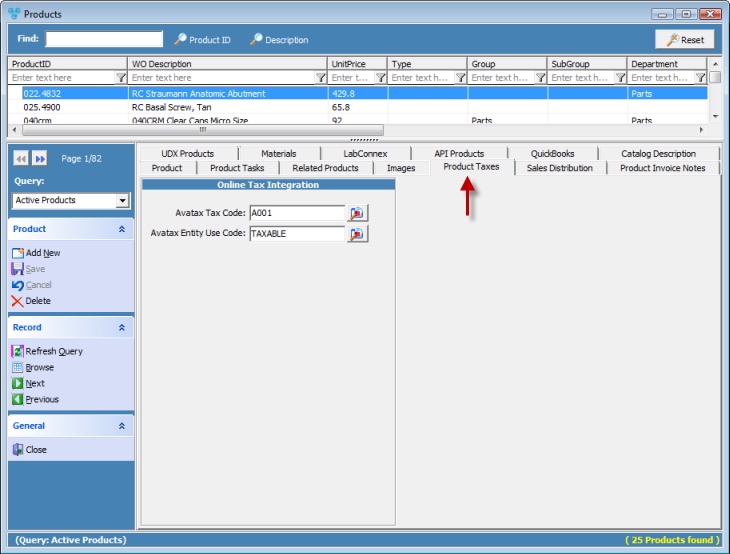

3. Navigation: File > Global Settings > Global > Products & Tasks Lists > Products > Select product > Product Taxes tab

Products - Product Taxes tab

•In addition to marking products as Taxable, proper mapping will need to be configured on each product code. In the Product Taxes tab, the following AvaTax fields may be defined:

➢Avatax Tax Code

➢Avatax Entity Use Code

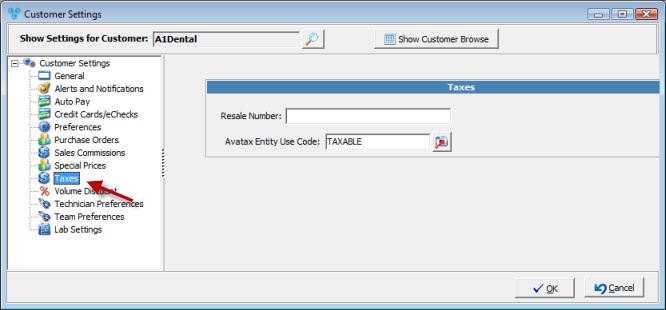

4. Navigation: Customers > Customer Settings > Taxes

Customer Settings > Taxes

•Customers that are subject to taxable and nontaxable sales must be defined with the following fields:

➢ Resale Number: This field can be used in the event the customer should be exempt from taxable sales.

➢ AvaTax Entity Use Code - To add a code please click on ![]() and select a code from the list.

and select a code from the list.

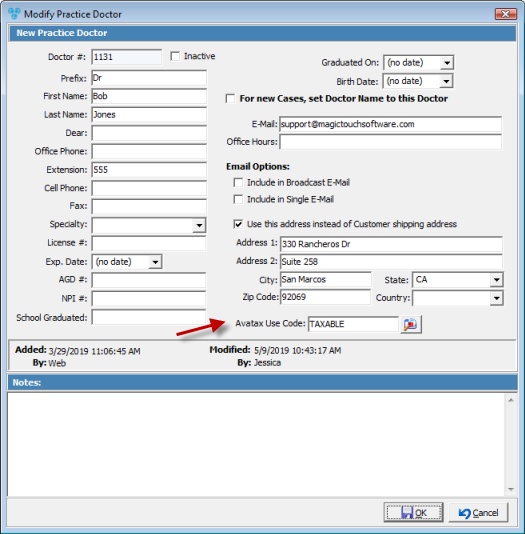

5. Navigation: Customers > Related Info > Practice Doctors

Practice Doctors

•Customer accounts that have practice doctors defined with a shipping address to use over the default shipping address may also set an AvaTax use code on the Practice Doctor account.

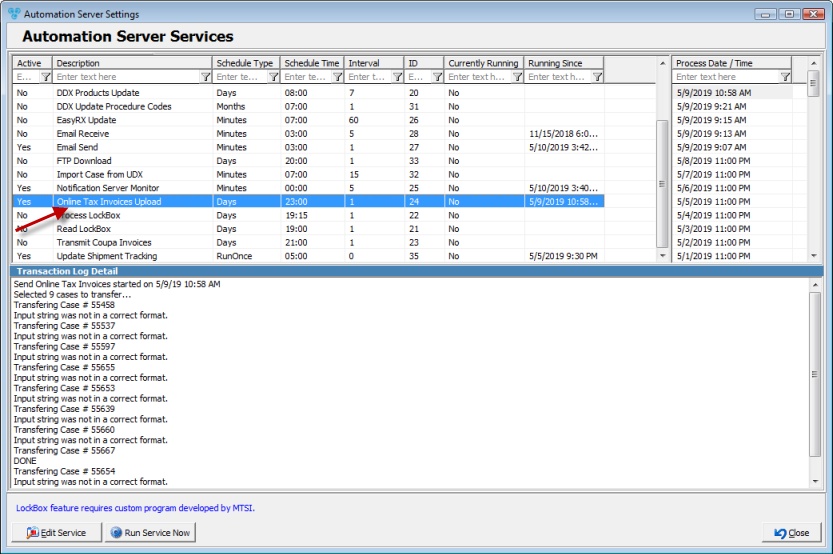

6. Navigation: Automated Services > Automation Server > Online Tax Invoices Upload

Online Tax Invoices Upload Job

•By default, this automated job is set run only once at the end of each day. This is by design to ensure that all cases that are invoiced for the day are confirmed. Administrative users with access to this section may adjust the configuration of this job only with the instruction and assistance of a Magic Touch Software Customer Support Team member.

See also: