Tax Rates Maintenance |

|

|

|

Tax Rates Maintenance |

|

|

Usage:

It is important for the Tax Rates application to your Customers are defined here so DLCPM can calculate an accurate tax amount for every case with taxable product(s).

Prerequisites:

Tax Groups -> Path: File > Global Settings > Global > Laboratory Lists > Tax Groups

Navigation: File > Global Settings > Global > Laboratory Lists > Tax Rates

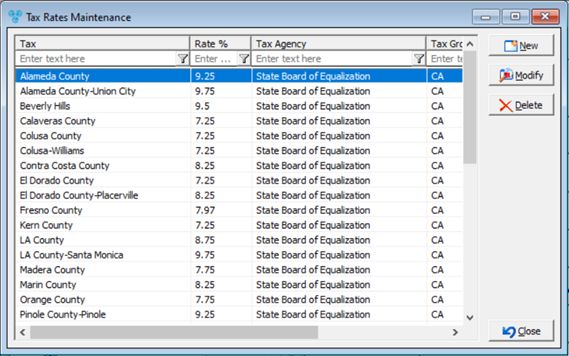

Tax Rates Maintenance form

1. Click 2.Enter the description of the new tax rate in the Tax field. 3.Enter the rate percentage in the Rate % field. 4.Enter the tax agency information into the Tax Agency field. 5.Enter Tax Groups if your laboratory handles large numbers of taxes. This options provides an easier way to add and remove multiple taxes. 6.Deactive On: set date - this option can be set ahead of time and will not be used in the tax calculation if expired. That means even if the customer has some taxes assigned to them, only the non-Expired taxes will be applied to Invoices. This has no impact on the cases that were previously Invoiced unless they are un-invoiced and Invoiced again. Please Note: The Deactive On field is not normally used and no date should be entered. However, there may be a short-term tax rate that may be applicable for a particular locale so this setting is available if needed. 7.Click Please Note: In order for taxes to populate into cases, there must be appropriate products marked as taxable and the correct tax code must be configured on the Customer Settings. |

1.Select the Tax Rate record you want to update by clicking on it. 2.Click 3.Enter the new name in the Tax , Rate or Tax Agency fields. 4.Change Tax Group if necessary. 5.Click |

1.Select the Tax Rate you want to delete by clicking on it. 2.Click 3.Select YES when prompted for confirmation. Note: Record will be deleted from the database, but you can add it back at any time. |

See also: